- Main Number

(855) 667-3655 - Emergencies

(800) 453-2530 - Crossing gates, signals & rough crossings

(800) 453-2530 - Environmental Spills

(800) 453-2530

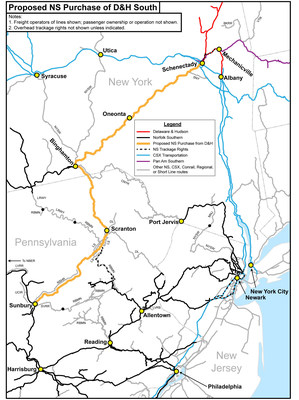

NORFOLK, Va., and CALGARY, Alberta, Nov. 17, 2014 /PRNewswire/ -- Norfolk Southern Corp. (NS) and the Delaware & Hudson Railway Co. (D&H), a subsidiary of Canadian Pacific Railway (CP) today announced a proposed transaction under which NS would acquire 282.55 miles of D&H rail line between Sunbury, Pa., and Schenectady, N.Y. The $217 million sale, subject to approval by the U.S. Surface Transportation Board, would benefit customers, competition, and jobs in the northeastern United States.

"Acquiring this portion of the D&H provides for more efficient rail transportation system by consolidating freight operations with a single carrier," said NS CEO Wick Moorman. "Aligning the D&H track with Norfolk Southern's 22-state network allows us to connect businesses in central Pennsylvania, upstate New York and New England with domestic and international markets while enhancing the region's competitive rail and surface transportation market."

The lines to be acquired connect with NS' network at Sunbury, Pa., and Binghamton, N.Y., and would give NS single-line routes from Chicago and the southeastern United States to Albany, N.Y., and NS' recently built Mechanicville, N.Y., intermodal terminal. NS also would gain an enhanced connection to its joint venture subsidiary Pan Am Southern, which services New England markets. Additionally, NS would acquire D&H's car shop in Binghamton along with other facilities along the corridor.

"As we have stated in recent months, we've been in the process of negotiating the final details for the potential sale of the southern portion of our D&H line," said CP CEO E. Hunter Harrison. "We are pleased to find a prospective buyer in Norfolk Southern."

As part of the transaction, NS would retain and modify overhead trackage rights on the line between Schenectady, Crescent, and Mechanicville, N.Y., as well as Saratoga Springs, N.Y. The D&H would retain local access to serve customers in Schenectady and would maintain its access to shippers in Buffalo.

NS intends to retain its current employees and offer employment to about 150 D&H employees currently working in this area. Any adversely affected employees will be entitled to standard labor protections.

"This acquisition would preserve good-paying railroad jobs and set the stage for economic growth," said John Friedmann, NS vice president of strategic planning. "Absent this transaction and its efficiencies, we are concerned that rail service along much of New York's Southern Tier would be threatened with losing a crucial link to New England."

NS has submitted an application for the transaction to the U.S. Surface Transportation Board. The rail companies are proposing a schedule that would lead to approval during the second quarter of 2015.

Norfolk Southern Corporation (NYSE: NSC) is one of the nation's premier transportation companies. Its Norfolk Southern Railway Company subsidiary operates approximately 20,000 route miles in 22 states and the District of Columbia, serves every major container port in the eastern United States, and provides efficient connections to other rail carriers. Norfolk Southern operates the most extensive intermodal network in the East and is a major transporter of coal, automotive, and industrial products.

Canadian Pacific (TSX: CP) (NYSE: CP) is a transcontinental railway in Canada and the United States with direct links to eight major ports, including Vancouver and Montreal, providing North American customers a competitive rail service with access to key markets in every corner of the globe. CP is growing with its customers, offering a suite of freight transportation services, logistics solutions and supply chain expertise. Visit cpr.ca to see the rail advantages of Canadian Pacific.

This news release contains certain "forward-looking statements" within the meaning of applicable securities laws relating, but not limited, to NS' proposed acquisition of a portion of D&H's rail line, CP's and NS' operations, priorities and plans, anticipated financial performance, business prospects, planned capital expenditures, programs and strategies. These forward-looking statements also include, but are not limited to, statements concerning expectations, beliefs, plans, goals, objectives, assumptions and statements about possible future events, conditions, and results of operations or performance. Forward-looking statements may contain statements with words such as "anticipate," "believe," "expect," "plan," or similar words suggesting future outcomes.

Undue reliance should not be placed on forward-looking statements as actual results may differ materially from the forward-looking statements. Forward-looking statements are not a guarantee of future performance. Among other risks, there can be no guarantee that the acquisition will be completed within the anticipated time frame or at all or that the expected benefits of the acquisition will be realized. By their nature, CP's and NS' forward-looking statements involve numerous assumptions, inherent risks and uncertainties that could cause actual results to differ materially from the forward-looking statements, including but not limited to the following factors: the occurrence of any event, change or other circumstances that could give rise to the termination of the agreement between CP and NS; the outcome of any legal proceedings that may be instituted against CP or NS and others following announcement of this agreement; the inability to complete the acquisition due to the failure to satisfy the conditions to the acquisition; risks that the proposed transaction disrupts current plans and operations; the ability to recognize the benefits of the acquisition; legislative, regulatory and economic developments, including regulation of rates; changes in business strategies; general North American and global economic, credit and business conditions; risks in agricultural production such as weather conditions and insect populations; the availability and price of energy commodities; the effects of competition and pricing pressures; industry capacity; shifts in market demand; inflation; changes in taxes and tax rates; potential increases in maintenance and operating costs; labor disputes and potential difficulties in employee retention as a result of the acquisition; risks and liabilities arising from derailments; transportation of dangerous goods; timing of completion of capital and maintenance projects; currency and interest rate fluctuations; effects of changes in market conditions; various events that could disrupt operations, including severe weather, droughts, floods, avalanches and earthquakes as well as security threats and governmental responses thereto, and technological changes. The foregoing list of factors is not exhaustive.'

These and/or other factors are detailed from time to time in reports filed by CP with securities regulators in Canada and the United States and in reports filed by NS with the SEC. Reference should be made to "Management's Discussion and Analysis" in CP's annual and interim reports, Annual Information Form and Form 40-F. Reference should also be made to NS' Annual Report on Form 10-K for the year ended December 31, 2013. Readers are cautioned not to place undue reliance on forward-looking statements.

Forward-looking statements are based on current expectations, estimates and projections and it is possible that predictions, forecasts, projections, and other forms of forward-looking statements will not be achieved by CP or NS or will be delayed or materially altered. Except as required by law, CP and NS undertake no obligation to update publicly or otherwise revise any forward-looking statements, whether as a result of new information, future events or otherwise.

Photo - http://photos.prnewswire.com/prnh/20141117/159082

SOURCE Norfolk Southern Corporation